Employer Guide: How to Pay EPF Contributions Online

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Instant Job Ads.

HIRE NOW

In Malaysia, a part of an employer's responsibility is to pay Employees Provident Fund (EPF) contributions for their workers under a contract of service or apprenticeship. Employers must ensure that the monthly contributions are appropriately deducted from the worker's monthly salary and paid to the EPF.

Nowadays, it is easier to make contributions to EPF online. This is how to pay EPF contributions online:

EPF Contribution Rate 2021

You can refer to the Third Schedule of the EPF Act 1991 to see the latest contribution rates for employers and workers effective January 2021. Employers need to pay EPF contributions based on this Schedule.

How to Pay EPF Contributions

1. Log in to the EPF's employer section website

Make sure to add this link to your bookmark: https://secure.kwsp.gov.my/employer/employer/login

Employers will need to enter their ID and password at the login page. Employers who have not registered with EPF can follow this guide.

2. Once you have logged in, click the 'Submit Contribution' button.

3. Select the contribution month.

The page will automatically show the month and year to help you make your contribution. Proceed by clicking 'Next'.

4. The amount of contribution needed to be paid.

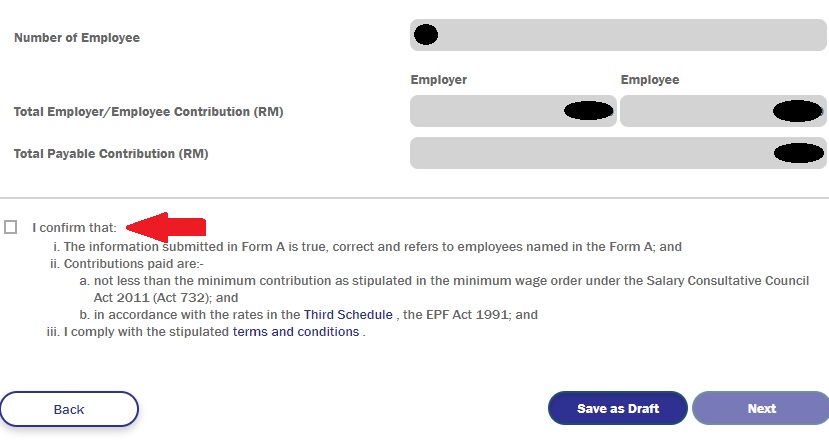

The following section will show the amount of contribution the employer will need to pay. The page will also show the total payable contribution for each member of the company.

When you are ready to proceed, tick the "I confirm that" box as shown in the image. Click 'Next'.

5. This page will display the payment methods for the contribution.

There are multiple options to choose from, including:

- Maybank2u,

- FPX (Online Retail Banking & Online Corporate Banking),

- Direct Debit Authorisation (DDA),

- Electronic Fund Transfer (for government employers only),

Once you have clicked your preferred payment method, click "Proceed".

6. EPF Payment is successful.

Please ensure to download the receipt by clicking the "Download Receipt" button before logging out of the EPF website. It is crucial for bookkeeping.

Contribution Payment Date

The employer has to ensure that they have paid contribution to the workers before the 15th of each month.

For instance, the employee's salary for January. Therefore, the contribution month is February 2021. The employer will need to make the contribution by February 15 2021.

For contribution rate calculation, please visit the EPF's website here:

https://www.kwsp.gov.my/en/employer/contribution/all-about-your-responsibility

Click here to Post Job for 30 Days + Get Extra 30 Days >> https://bit.ly/3572wfO.

If you have any questions, please feel free to Whatsapp us at 018 966 6610 / Click Here >> https://bit.ly/3xcII6G

Articles that might interest you

How to Register Your Company for Vaccination Under PIKAS

How to Renew Your SSM Business Registration Online

How to Register for PEMERKASA+'s PSU 3.0