How to Apply for EPF's Special Withdrawal Facility

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Instant Job Ads.

HIRE NOW

Starting April 1, Employees Provident Fund (EPF) members who want to withdraw their savings under the latest withdrawal facility can do so via the pengeluarankhas.kwsp.gov.my portal. They can also access it via the i-Akaun mobile application.

How the latest withdrawal facility works

Based on EPF's latest statement, it will credit a single payment of the amount withdrawn directly into the members' current or savings bank accounts.

Members should ensure their bank accounts are active and registered under their names. The transfer of the fund into shared bank accounts or business registered accounts is not allowed.

Members can start checking their application status beginning April 9 through the pengeluarankhas.kwsp.gov.my portal.

The requirements for the special withdrawal facility.

EPF special withdrawal facility's terms and conditions

Before applying for withdrawal, the EPF reminded its members to check their savings balance through the i-Akaun (member), i-Akaun mobile app, or EPF Kiosk.

-

The facility is open to members under 55 years old.

-

Members can start applying from April 1 until April 30.

-

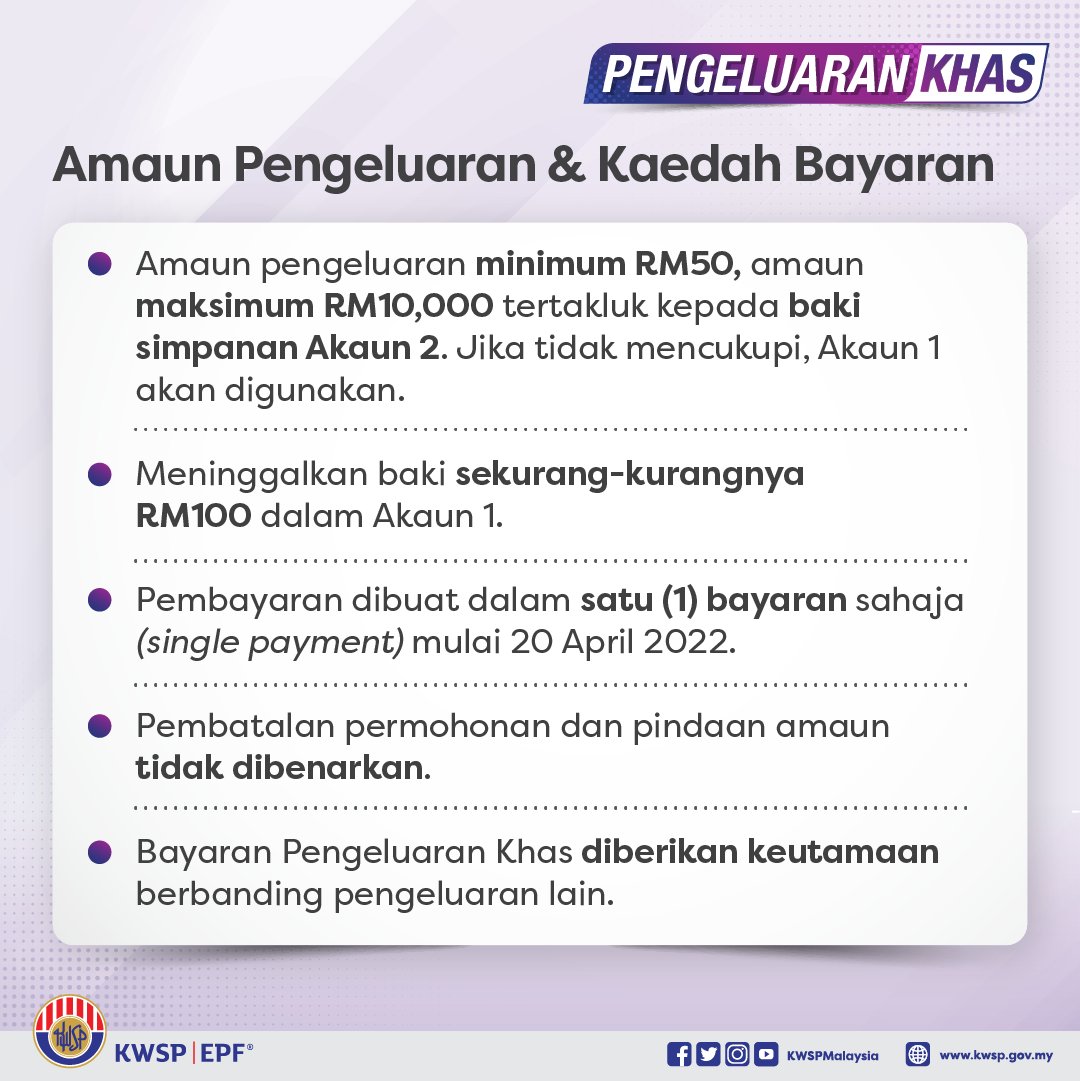

The payment will be made beginning April 20.

-

The minimum amount for withdrawal: RM50,

-

The maximum amount allowed: RM10,000.

-

EPF members must fully utilise their savings balance in Account 2 before accessing Account 1.

-

Members must also leave a minimum of RM100 in their account.

Visit the EPF website, Facebook, Twitter and Instagram, or contact the Special Withdrawal Facility hotline at 03-8922 4848 starting April 1 for more details.

The amounts and payment method.

The purpose of EPF special withdrawal facility

EPF said the facility aims to assist members who are still financially affected by the pandemic to meet today's urgent needs. It reminds its members to consider their long-term income security and only to withdraw if it is absolutely necessary.

The members can talk to the EPF's Member Advisory Service at EPF branches countrywide for advice on their savings.

Before this, the pension fund said the withdrawal facility announced by the government on March 16 to help the people cope with the Covid-19 pandemic's impact should be the last withdrawal facility.

EPF had reiterated its concerns about the retirement security of Malaysians, provided that many have incredibly insufficient funds.

Remember to update your mobile phone number and check your EPF balance before applying.

Finance Minister's warnings

Finance Minister, Tengku Zafrul Abdul Aziz Tengku Zafrul, had earlier warned that the EPF would need to dispose of more overseas investments and stop domestic investments in the short to medium term if another RM10,000 withdrawal was allowed.

He cautioned the portfolio rebalancing that the EPF would need to do to accommodate the withdrawal would affect the future dividends it could pay its members and its position as one of the largest bond and domestic equity investors. Additionally, it would impact EPF's role as a liquidity provider for the government bond market.

Tengku Zafrul also disclosed that 2021's EPF dividend rate would have been higher at 6.7%, compared to the 6.1% announced recently. He added that an extra dividend of RM5.4 billion could have been distributed to all EPF members if there had been no special withdrawal facility.

6.1 million EPF members have less than RM10,000 in savings

The EPF said that 6.1 million members have less than RM10,000 in savings, whereas 2.1 million members have less than RM1,000. Currently, the pension fund has about 15 million members.

Since the pandemic began, the government had allowed the withdrawal of EPF contributions via three schemes: i-Lestari, i-Sinar and i-Citra, which amounted to RM101 billion and involved 7.34 million contributors.

Source: The Edge Markets