HR Guide: The Basics of Form E

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Instant Job Ads.

HIRE NOW

Did you know that over 65,000 employers were found guilty of not submitting Form E in 2014? If you're an employer, you should know better to remember the tax forms and submit them on time. In this case, it's Form E.

Filing tax forms is stressful, as you need to gather all the details and not miss any of them. In this article, we'll explain the basics of Form E, a.k.a Borang E.

1. What is Form E?

Form E is a declaration report, and every employer must submit the form to the Inland Revenue Board of Malaysia (IRBM) each year.

Form E contains these details:

i. The full number of employees employed by your company;

ii. The number of new employees you have hired;

iii. The details of the employer;

iv. The details of every employee. An employer must have the details of all persons employed in any type of arrangement under one's company in Form E, including interns;

v. A list of every employee's income details*:

- Employees with annual gross remuneration of RM34,000 and above

- Employees with monthly gross remuneration of RM2,800 and above (this includes bonuses, except prior years' salary arrears)

- If an employee's income is less than the stipulated, the employer should insert "0" in part A of the employee data section.

2. Who must file for Form E?

Every company must file Form E, even if they do not have any employees, including:

- Public limited company (Berhad)

- Private limited company (Sdn Bhd)

- Sole-Proprietor

- Partnership

- Dormant & Non-performing companies

3. The deadline

These are the deadlines for filing tax returns:

- Manual submission: April 30

- Electronic filing (Form e-E): April 30

You might have heard that LHDN does not accept manual submissions from companies anymore, yet the deadline for it is still there. The reason is that employers who are not companies have the choice to send in Form E through e-Filing or paper form.

4. Form E submission process

-

Go to ezHasil, enter your NRIC number and password. Click First Time Login if it's your first time, and insert the PUN and IC number to register.

-

Click e-Form under e-Filing.

-

Select the Year of Assessment under e-E (Non-Individual).

-

Key-in Employer no. or Company Registration Number and click Proceed.

-

Fill in the company data.

-

Under section "Return of C.P.8D", you can refer to this guide by IRBM.

-

After filling up the required details, you can sign off and submit via the "Tandatangan & Hantar" button. Remember to print a draft copy for safekeeping by clicking "Cetak Draf Borang".

5. Important data on Form E

i. Name of Employer: It should be as registered with the Companies Commission of Malaysia (SSM).

-

If there's any change to the name, you can put the former name in parenthesis.

-

If the employer is not registered with SSM or others, they can fill in the name as per IC or passport.

ii. Employer's Number: for example, E12345678.

iii. Status of Employer: You can indicate the status code by referring to this:

-

Code 1 for Government.

-

Code 2 for Statutory.

-

Code 3 for Local Authority.

-

Code 4 for Private - Company.

-

Code 5 for Private- Other than company.

iv. Status of Business: If the company has never started operations since the date it was incorporated, the status of business should be Dormant. If the company had previously been in operation but has now stopped, it is also considered Dormant.

-

Code 1 for In Operation

-

Code 2 for Dormant

-

Code 3 for In The Process Of Winding Up

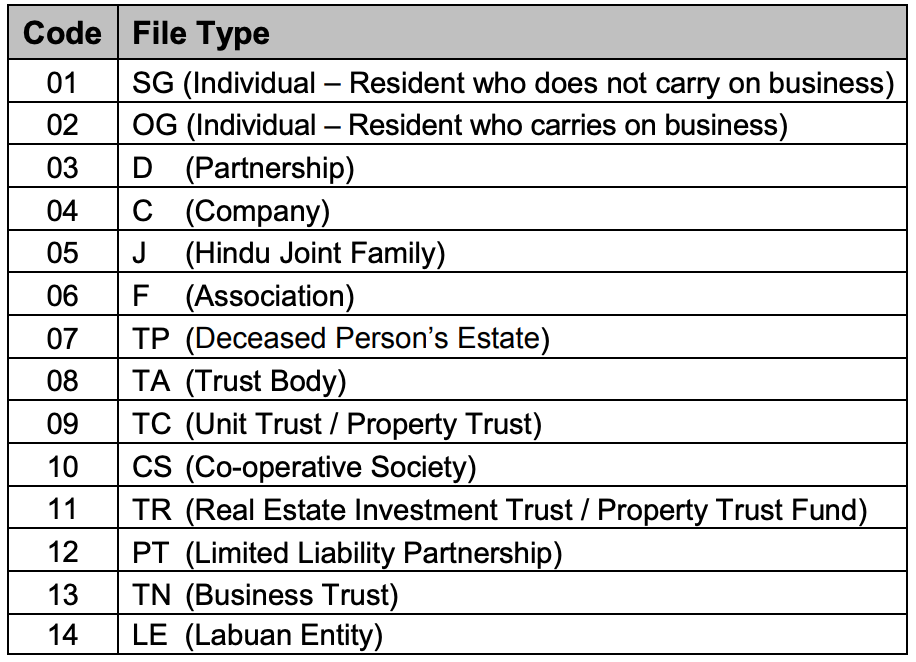

v. Income Tax Number: The first two numbers are the File Type Code, the following string of 11 numbers is the Income Tax Number. You can refer to the employee's File Type Code below:

vi. Identification Number and Passport Number: The data need to be indicated by the precedent partner or sole proprietor of the company, if any.

vii. Registration Number with SSM or Others

viii. Correspondence Address, Telephone Number, Handphone Number and Email

ix. Return of C.P.8D: Here's where you submit the relevant code for the method of submission.

-

Code 1 is for Together with Form E

-

Code 2 is for Via Data Praisi

-

Code 3 is for Compact disc / USB drive / external hard disk

6. Number of Employees for YA 2020

This part is about employee data as a whole in the year 2020.

i. Total number of employees as of 31/12/2020: This includes full-time/part-time/contract employees and interns.

ii. Number of employees subject to MTD/PCB: The number of employees subject to the Monthly Tax Deduction (MTD) scheme during 2020.

iii. Total number of new employees: The number of employees who began employment in the company during 2020.

iv. Number of employees who ceased employment: The number of employees who stopped employment with the company in 2020.

v. Total number of employees who ceased employment and left Malaysia: The number of employees who stopped employment with the company and left the country in 2020.

vi. Reported to LHDN (if A5 is applicable): This part has to be completed if item A5 is applicable.

-

Submit "1" for Yes if the employer has reported the cessation to LHDN/IRBM

-

If one submits "2" for No, they must immediately contact the IRM branch in charge of the employee's income tax file.

7. Return of Remuneration from Employment, Claim for Deduction and Particulars of Tax Deduction for YA 2020

This form focuses on each employee info, including child relief, the total claim for employee through Form TP1, and total tax reduction.

.png)

Click the picture for the full size.

Most parts are straightforward; we're highlighting the tricky ones:

E. Category of Employee: Use the code for relevant employees:

-

1: Single

-

2: Married and unemployed spouse

-

3: Married and spouse is working, divorced or widowed, or single with an adopted child.

F. Tax Borne by Employer:

-

Enter 1 for Yes if the employer receives benefit from tax borne by their employer (tax allowance).

-

Enter 2 for No if the employee did not receive this benefit in 2020.

M. List of Tax-exempt Allowance/Perquisites/Gifts/Benefits

-

Petrol card/petrol or travel allowances and toll rates

-

Childcare subsidies/allowances

-

Parking fees/allowances

-

Meal allowances

-

Income tax borne by employer

-

Interest on loan subsidies

-

Award

-

PTPTN

For more information, you may refer to this article.

If you need assistance with e-Filing, you may contact ezHASiL at 03-8911 1000 or +603-8911 1100 if you're abroad.

Sources: PayrollPanda, LHDN, Talenox

Articles that might interest you

Income Tax E-Filing for 2020 Begins on March 1

Access Unlimited & Free Online Training Courses at e-LATiH

How to Obtain Approval for Workers' Hostel (Act 446)