Maybank Simplifies Banking for SMEs With Maybank2u Biz

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Instant Job Ads.

HIRE NOW

Maybank recently launched a new mobile app for small and medium enterprises (SMEs). This app aims to simplify and secure SMEs banking requirements, provide them with the tools to assist with their non-banking requirements and ease business operations.

Called Maybank2u Biz, the lender, via a virtual launch, announced that Maybank developed the new app to cater to the needs of busy business owners who handle various tasks. The app is the right fit for:

-

Partnerships,

-

Private limited companies,

-

Professional firms,

-

Associations,

-

Clubs,

-

Educational Institutions, and

-

Society.

Maybank highlighted that the Maybank2u Biz app has fresh features such as:

-

An invoicing tool that allows business owners to create, issue and track invoices. These invoices can be customised using templates and send to clients through various channels such as email and messaging apps.

-

SMEs can easily access their in-depth financial information via the app. Maybank2u Biz provides a complete view of the company's accounts on its dashboard.

-

SMEs can also download a year's worth of cash flow data in spreadsheet format (CSV) on-demand, without waiting for the traditional month-end statements. Business owners can now plan ahead, make better decisions, and notice potential red flags in their cash flow early on.

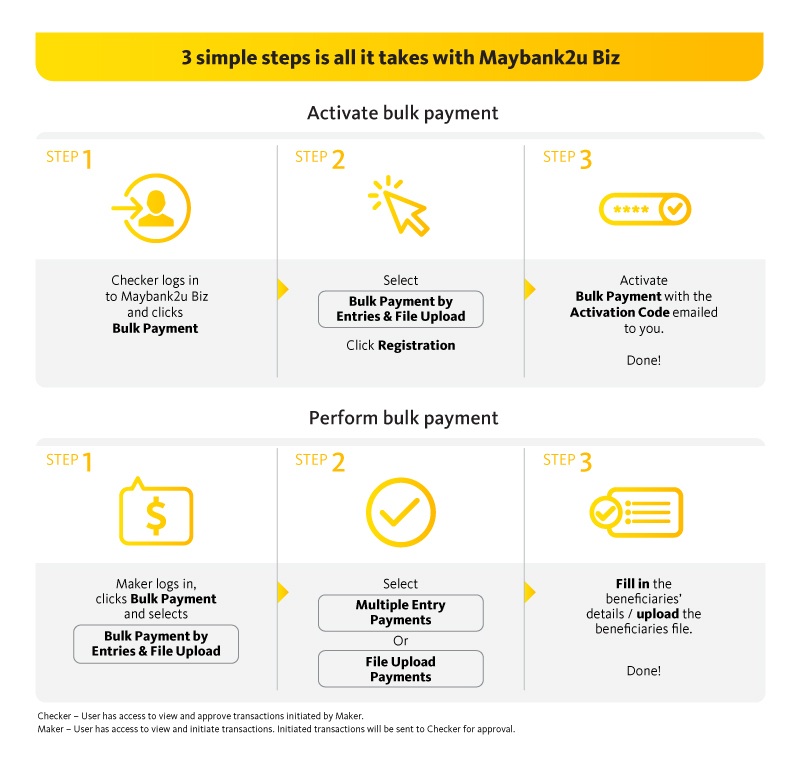

The Maybank2u Biz app also allows business owners to perform bulk payments via their smartphones.

The CEO of Maybank's community financial services, Datuk John Chong Eng Chuan, stated that it is timely for Maybank to roll out the app to help SMEs simplify things and make work more efficient.

He said this allows SMEs to concentrate on what is important to them, including their business recovery plans, as the economy is slowly recovering.

Maybank currently serves about 58% of all SMEs in Malaysia. Chong said that 67% of the total SME customer base served by Maybank uses various digital platforms. Maybank's goal is to raise it to 80% by next year.

Maybank group president and CEO Datuk Abdul Farid Alias said the Maybank2u Biz launch reaffirmed the bank's commitment to supporting SMEs.

He believes SMEs would welcome the app as it's equipped with features such as an intuitive interface, easy navigation, and helpful business tools. He said that it is only the first phase of the Maybank2u Biz app, and they will continue to improve it and add more features that will help SMEs enhance their businesses.

According to Farid, Maybank designed the app to be more than just a banking application but a business companion that will help ease SMEs' burden and empower them to move their businesses forward.

What can you do with Maybank2u Biz?

-

Review real-time account balance.

-

Transfer funds locally & overseas.

-

Make bill payments, payroll and bulk payments to staff, suppliers or business partners.

-

Make statutory body payments such as income tax, SOCSO, EIS to staff.

Maybank2u Biz's Type of Users

With Maybank2u Biz, business owners can select different access levels to the account according to their business structure. Each appointed user can hold one type of access only (up to a maximum of 5 users).

There are 3 access types:

-

The Viewer - Can view account details only.

-

The Maker - Can view and initiate transactions, which they will send to the Checker for approval,

-

The Checker - Can view, approve transactions initiated by the Maker and upload Maybank AutoCredit files only.

How to Apply for Maybank2u Biz

Step 1

Schedule an appointment online with your selected branch via Maybank EzyQ.

Step 2

Download and fill-up the Maybank2u Biz registration form, along with the documents below:

-

Authorisation Letter (for Govt Educational Institution)

-

Company's Board Resolution (for Private Limited Company/Sdn.Bhd)

-

Mandate Letter (for Partnership and Professional)

-

Annual General Meeting (AGM) Minutes OR Committee Minutes of Meeting, signed by Chairman, Secretary and Treasurer (for Club, Society and Association)

Step 3

Visit the branch according to the scheduled appointment. Ensure the appointed Maybank2u Biz users are presented and bring along the documents and photocopies of the users' NRIC.

Upon successful confirmation, the branch will provide an access number and a 6–digit PIN to the users for first-time login on Maybank2u Biz.

Step 4

The users can click here to activate their Maybank2u Biz account. Key in the access number and 6-digit PIN provided, create a username and password.

To learn more about Maybank2u Biz, please click here.

You can download the application from the Google Play Store and Apple AppStore.

Source: The Edge Markets

Articles that might interest you

No Entry of Foreign Workers Until December 31, 2021

Employers Can Now Get COVID-19 Self-Test Kits From SOCSO

Clinic Assistant Unfairly Dismissed After 37 Years of Service