Personal Tax Relief 2023 in Malaysia

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Instant Job Ads.

HIRE NOW

Tax season is upon us!

As Malaysians gear up to file their taxes, it's crucial to stay informed about the latest tax reliefs for 2023. These reliefs can help taxpayers maximize their savings and reduce their tax burden.

Don't miss out on this important information before the deadlines!

For those filling out the BE Form (applicable to residents who do not conduct business), the deadline is set for 30 April 2024 for manual filing or 15 May 2024 for e-filing. Make sure to mark your calendars and submit your forms on time to avoid any penalties!

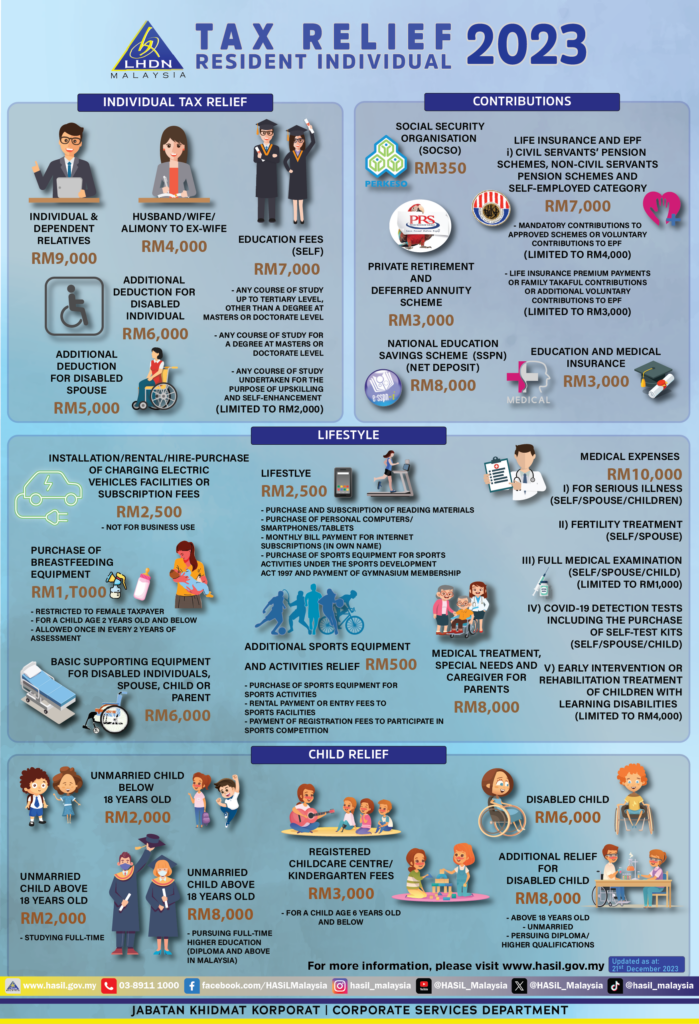

Details of Personal Tax Relief 2023

Tax Relief for Individuals and Spouses

1. Individual and Dependent Relatives RM9,000

2. Education Fees RM7,000

-

For tertiary level or postgraduate level

-

Personal upskilling and self-enhancement course (Limited to RM2,000)

3. Spouse / Alimony RM4,000

-

For spouses without income

-

Alimony to former wife (Agreement needed)

4. Disabled Individual RM6,000

5. Disabled Spouse RM5,000

Contributions

1. SOCSO RM350

2. EPF RM4,000

3. Private Retirement and Deferred Annuity Scheme (PRS) RM3,000

4. National Education Savings Scheme (SSPN) RM8,000

5. Education and Medical Insurance RM3,000

6. Life Insurance RM3,000

Tax Relief for Child

1. Unmarried Child

-

Below 18 years old RM2,000

-

Above 18 years old (Full-time study) RM2,000

-

Above 18 years old (Full-time higher education: diploma and above) RM8,000

2. Childcare Centres or Kindergartens Fees RM 3,000

-

Child ≤ 6 years old

3. Disabled Child RM6,000

4. Additional Relief for Disabled Child RM8,000

-

Above 18 years old

-

Unmarried

-

Pursuing Diplomas or higher qualification

Tax Relief for Family (Lifestyle)

1. Charging Electric Vehicle Fees

-

Including Installation, Rental, Hire-Purchase, or Subscription Fees

-

Only for personal use

2. Purchase of Breastfeeding Equipment RM1,000

-

Only for female workers

-

Child ≤ 2 years old

-

Claim once every 2 years

3. Basic Supporting Equipment for Disable Individual, Spouse, Child or Parent RM6,000

4. Sports Equipment and Activities Relief RM500

-

Purchase of sports equipment

-

Rental payment or entry fees to sports facilities

-

Payment of registration fees to participate in sports competition

5. Medical expenses RM 10,000

-

Serious illness (Self / Spouse / Children)

-

Fertility treatment (Self / Spouse)

-

Full medical examination (Limited to RM 1,000)

-

Vaccination expenses (Limited to RM 1,000)

-

Expenses for children with learning disabilities (Limited to RM 4,000)

-

Autism Spectrum Disorder

-

Attention Deficit Hyperactivity Disorder (ADHD)

-

Global Developmental Delay (GDD)

-

Intellectual Disability

-

Down Syndrome

-

Specific Learning Disabilities.

6. Medical expenses for parents RM 8,000

-

Include Medical Treatment, Special needs and Caregiver

Source from LHDN

Read More on Ajobthing :

- How To Be a Good Interviewer: Strategies for Interviewing

- How to renew SSM online via EzBiz SSM

- Top 10 Reasons Why a Company Needs Merchandise

- 7 Easy Steps to Register Your Sdn. Bhd. Company with SSM Malaysia

AJOBTHING: Your All-in-One Hiring Solution

With AJOBTHING, you get everything you need for hiring in one place. Our HR libraries are packed with helpful resources, and our recruiter advice is personalized to your hiring needs. No more juggling multiple platforms. With AJOBTHING, everything you need is in one convenient place. Join us today and see how we can make hiring simpler and more effective for you.

Urgently seeking candidates to hire?

Look no further! AJobThing offers an effective hiring solution with our instant job ad feature. Hire in just 72 hours! Try Now!