A Step-by-Step Guide to File Income Tax Online

Create Job Description Using AI

Write appealing job descriptions for any job opening to attract the most qualifield and suitable candidates. FOR FREE.

try now

Nowadays, it's easier to do most things online, and that includes income tax filing. Yes, it's still stressful, but now you can be stressed at home instead of the Lembaga Hasil Dalam Negeri (LHDN) office.

If you want to file your income tax online, then this is the right article for you.

Do I need to file income tax?

The rule is simple, any person earning a minimum of RM34,000 annually after EPF deductions has to register a tax file.

Your earning is not only your work salary. It includes all of your income sources.

How to register for first-time taxpayer online

.png)

For individuals, choose Borang Pendaftaran Online under Daftar Individu.

-

Under Daftar Individu, click Borang Pendaftaran Online.

-

Fill in the form.

-

Confirm your information.

-

The site will show your application number. Please write it down for future reference.

-

Scroll down and click Muat Naik Disini. Upload a copy of your identity card.

-

You can then obtain the e-Filing PIN via visiting the nearest LHDN branch or online.

How to apply for an e-Filing PIN for individuals

.png)

This section is where you apply for the e-Filing PIN.

-

Visit LHDN's Customer Feedback site, click Application category, click "e-Filing PIN Number Application."

-

You will need these documents in pdf format:

-

Copy of applicant's I.C./passport

-

If there are any changes in your personal details, include Form CP600B.

-

-

Click "Next".

-

Fill in the form.

-

Under the CP600B Attached section, select "No".

-

Attach the mentioned files in step 2 under the Attachment section by clicking Choose Files

-

Under the Details section, type in "Form CP55D and I.C."

-

Click "Submit".

-

Save the reference number, just in case.

-

LHDN will only send you the PIN number via email.

Now, you're ready to file your taxes using e-filing.

Filing your taxes as an employee via e-Filing

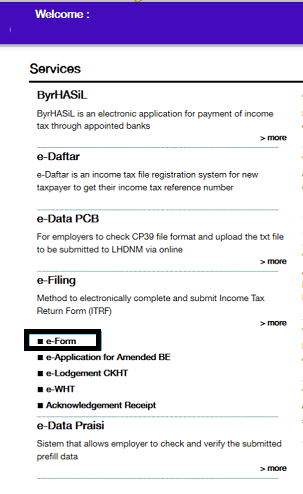

e-Form is where you choose Form BE.

-

Go to ezHASiL.

-

If it's your first time logging in, click "First Time Login" and add the PIN number you've received from the process above. If it's not your first time, skip this step.

-

Under e-Filing section, select "e-Form"

-

Select e-BE

-

Under Year of Assessment, choose the previous year, which is 2020 (if you're reading this in 2021. If not, it's the previous year of the current year).

-

The first section is "Individual Particulars", which would already fill up your details. Input the right bank and bank account number so LHDN can remit any excess money.

-

Proceed to the second section. Your employer should have sent you an EA Form with an amount listed. Key in that amount in the field titled "statutory income from employment".

-

You can also add details for other income sources (if any) such as:

-

Rents

-

Dividends

-

Interests, discounts, royalties, pensions, annuities, periodical payments, premiums, and other gains or profits.

-

-

Proceed to the third section. This section is where you key in your tax deduction/relief. Read this article to find out more about tax reliefs. Remember to keep all the related receipts for the items you're claiming for your tax relief.

-

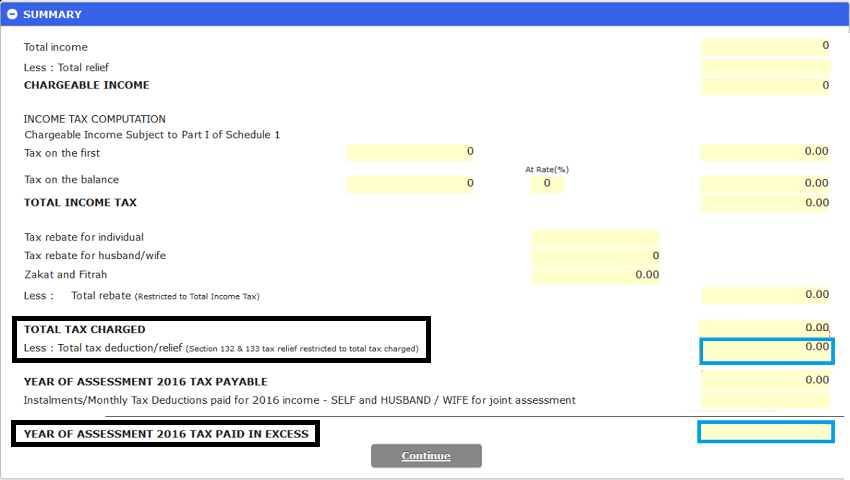

Proceed to the last section, "Summary". The system calculates everything automatically. There are two crucial parts:

-

Under Total Tax Charged, it is where you find out how much you owe the government.

-

Under Year of Assessment 2020 Tax Paid in Excess, you find out how much the government owes you.

-

-

Select "Continue" and declare that the information you have provided is accurate.

-

Click "Submit". You have until 30 April 2021 to pay your taxes.

-

Save the completed form as a PDF for safekeeping.

Total Tax Charged is how much you owe the govt, and Year of Assessment Tax Paid in Excess is how much the govt owes you.

Congratulations, you have filed your taxes via e-Filing! See, that wasn't so hard, was it? Either way, you've made it through and that's what truly matters.

Types of tax relief

You can claim these tax reliefs for the year of assessment 2020.

Articles that might interest you

Five Things to Remember When Filing Your Taxes

What Is Form CP58 and Do You Need to Prepare It?

You Can Claim These Tax Reliefs for Year of Assessment 2020