What You Need to Know About Wage Subsidy Programme (WSP)

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Instant Job Ads.

HIRE NOW

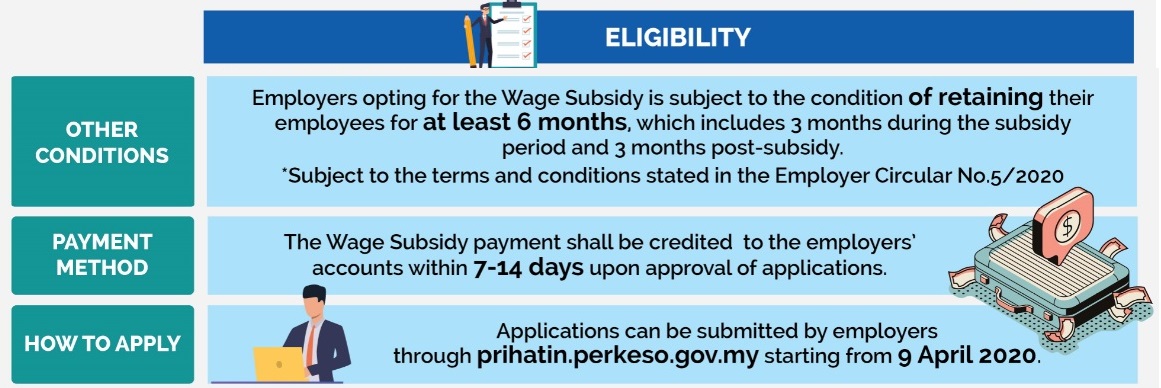

On March 2020, The Prime Minister announced the Wage Subsidy Programme (WSP) to help employers who are economically impacted by Covid-19 and to make sure they can continue operating their business while stopping the employees from losing their jobs.

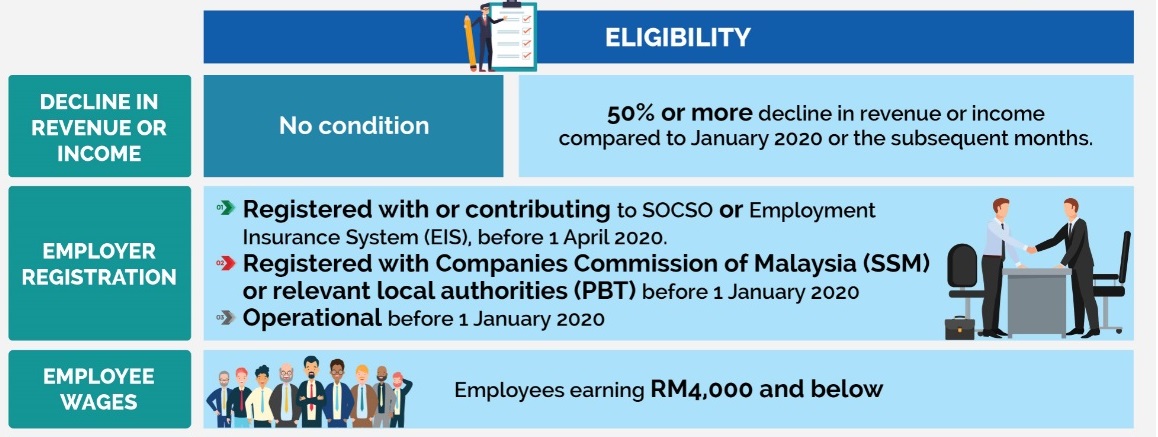

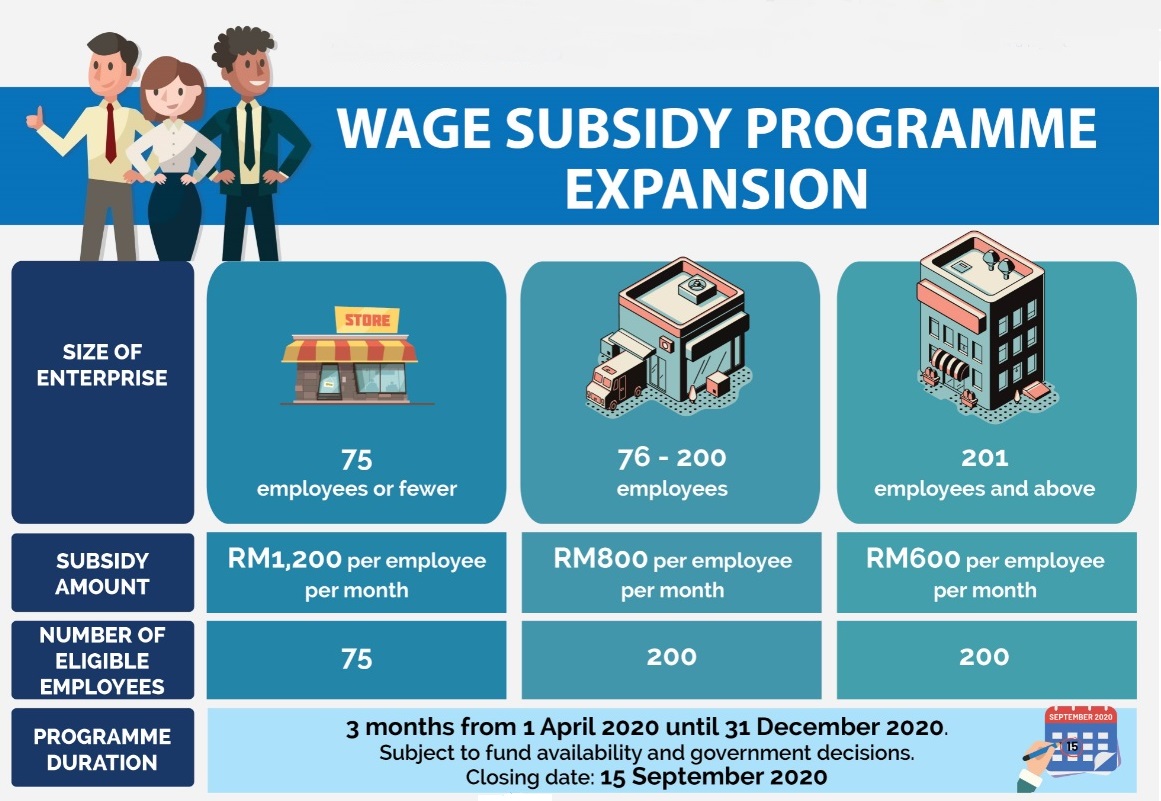

Malaysians who earn less than RM4,000 a month are eligible for the subsidies with the amount depending on the size of the company’s workforce. Businesses that hire more than 200 people will receive RM600 per retained employee while those hiring between 75 and 200 employees will get RM800. The companies with fewer than 75 employees will receive RM1,200.

Here are the frequently asked questions (FAQs) about the programme.

Q: What is the Wage Subsidy Programme (WSP)?

A: It is financial aid paid to the employer of each organisation for each local employee who earns a salary of RM4,000 monthly and below. Originally, the subsidy was for a period of three months, but this was extended for three more months.

Q: When does the WSP come into force?

A: The WSP began on 1 April 2020 for six months or when the application was submitted.

Q: When does the programme end?

A: The deadline for applications is 30 September 2020.

Q: Can employees who are instructed to take unpaid leave apply for WSP, which was previously covered under the Employment Retention Program (ERP)?

A: The ERP will be incorporated under the WSP beginning on 15 June 2020. The expansion of this WSP covers employees who have been told to take unpaid leave, given that they work in the tourism or other sectors that are still banned from operating during the recovery movement control order. The employer can apply for WSP granted that the employee receives direct subsidy payments. Employers under the tourism sector must verify their industry activities when submitting a WSP application.

Q: Who is not eligible to apply for WSP?

A: These are the companies or employers that are not eligible for WSP:

-

Companies or employers that register and operate on or after 1 January 2020.

-

Unregistered employers or employees who never contributed to Socso before April 1 are also not eligible.

-

The WSP does not cover employees who are paid more than RM4,000 monthly, retired employees, public sector workers, and the self-employed.

Q: What is the definition of income of RM4,000 and below intended for this WSP application?

A: The interpretation of salary or income is in accordance with the Employees’ Social Security Act. All payments in the form of money to employees is regarded as salary including:

-

commissions,

-

overtime pay,

-

incentive allowances,

-

living expenses, and

-

service charge.

Q: Can employers who have been operating before 1 January 2020 but not registered with Socso apply for WSP?

A: No. Any employer who wishes to apply for WSP must have registered with Socso before 1 April 2020. They also must be registered with the Companies Commission of Malaysia, local authorities or other professional bodies before 1 January 2020 and has at least one employee.

Q: If an employer applies for the WSP in June, will the wage subsidy be paid from April (backdated) or starting in June?

A: Wage subsidies will be paid from the month of the application submitted, with no backdated monthly payments. Applications received before 30 September 2020 will receive a six-month wage subsidy.

Q: If an employee who previously received the WSP resigns, do employers need to submit a new application?

A: No. Employers do not need to submit new applications and only need to update employee information by submitting a new list of workers through the Prihatin portal the following month. The employer’s failure to report such changes may be subject to legal action.

Source: The Star

Looking for Non-Executive Staff? AJobThing.com is your top choice to hire quickly and efficiently. Try it today!